With nearly 40 million Internet users and the fastest growing Internet population in the world in the last 5 years, Internet usage has seen significant growth here in the Philippines. And, commercial players, like banks have not been slow to adapt to the changed environment; they have extended their product and service reach to the Internet. One such example that we are going to examine today is online loan application and how you can go about applying for a loan online:

Visit the Bank’s Website

Go to the bank’s website; the site would have a page or a section, devoted completely to loans. You can easily find this link in the “home” or the “top” menu of the bank’s website. Once you’ve located the link to the loans section, click and navigate to it.

Check out the Loans Section / Pages

The Loans section of a bank’s website would most probably be categorized according to loan type. So, you will find pages devoted to personal loans, home loans, auto loans etc. You can move on to the type of loan that you require. The individual loan product pages will provide you will a detailed listing of the features and benefits associated with the loan, the terms and conditions related to its usage and the eligibility requirements for that loan.

Make Use of Online Calculators

Another set of great tools provided by banks on their websites are the loan calculators. A loan, especially one like a home loan, involves a considerable commitment on your part. So, it is essential that you understand exactly what you are commiting to and these calculators will help you do so.

Open the calculator, enter your current income details and your loan requirements including the amount that you are looking for, the tenor of your loan, fixed or floating rate of interest etc; the loan calculators will help you understand the quatum of loan that you are eligible for and will help you determine the monthly repayments that you can afford given your financial commitments.

Apply Online

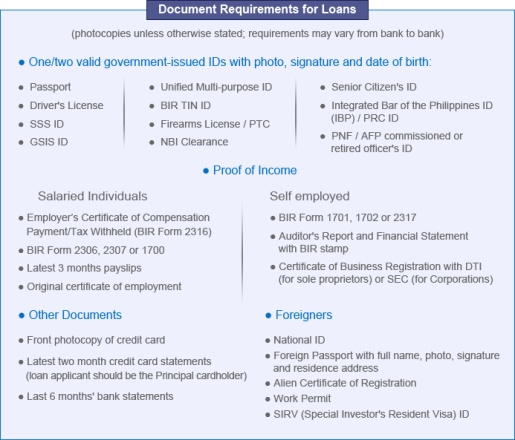

Finally its time for you to Apply for a Loan Online! You will be required to enter some personal information including your gender, date of birth, address etc. This may be followed by your income details and the details of the loan. You may also be required to submit your documents online. So, keep the latest copies of your IDs and other documents ready.

Post your application, your bank will process your application and get back to you from within a few hours to a couple of days. Also, while applying online take your time, ensure that you do not miss out on any details and do not fudge/misrepresent any details. You will most likely get caught out and not only will your loan application be rejected, your standing with that particular bank may be damaged. If you have any doubts regarding filling out a particular field, check with the banking staff who will only be glad to help you.

Online Loan Management

Online banking also makes it easy for you to manage and administer various aspects of your loan. You can generate statements, make repayments, set up Standing Instructions (SI) for paying your loan installments and more – all online.

Another big advantage of going online for a loan is that since all banks have posted details about their product offerings on their websites, it makes it easy for you to shop around and look at similar loan products from different banks. You can also use loan comparison sites to decide which is the best loan available for your requirements and then you can go for it – online, of course!