Loans are a great way to turn your dreams and aspirations into reality. And, personal loans are one of the most flexible loan products available out there. This is because they are non-collateralized and hence can be put to any use that you, the borrower, may deem fit. This could be financing your European holiday, tuition fees for your child, home renovation, getting the latest gadget etc.

And, with the Internet making things so much faster, applying for a personal loan need not be the long, laborious process it used to be earlier. Here, we will take a look at how you can go about applying for a personal loan online:

To apply for a personal loan from a particular bank visit the bank’s website. Usually a bank’s website will have different products / services grouped under broad categories. For instance, auto loans, car loans, home loans, personal loans, overdraft etc may be grouped under a broad “Loans” heading. These categories can be easily accessed from a menu on the bank’s website. Locate the category to which the product that you wish to apply for is listed and navigate (click on) to it.

Check out the product pages

Clicking on the product category page will take you to a page / section devoted to the various products available under that category. Go and check out the specific product that you are looking for.

Use Online Calculators

Many banks provide users loan calculators on their websites with which to better understand how personal loans work. You can enter the loan amount you are looking for and the tenor of the loan and the Calculator will help you determine the probable monthly repayment installment amount.

Some Calculators will require you enter your income details and these Calculators will also help you understand your loan amount eligibility. However, remember that such loan calculators will not take into account any fees that may be deducted from your loan proceeds like processing and disbursement fees, documentary stamp tax, insurance etc.

Third-party websites

There are a number of third-party service providers who will help you compare personal loan products from different banks; you can even order your search results through filtering criteria like interest rate, monthly installment amount etc.

A few examples

▪ Citibank provides you with a short form where you will be requested to leave a few personal/contact details and you will be contacted within 3 hours by someone from the bank who will help you with your application.

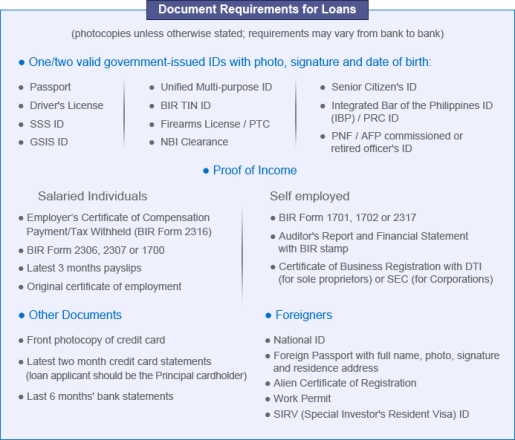

▪ Maybank provides you with a more detailed form and also requires you to scan and submit a required set of documents.

▪ BDO Unibank provides you with an application form online that you will need to download, fill and submit to a branch.

▪ You can even visit a third-party service provider like imoney.ph. You can use their comparison table, find the loan that best suits you and click “Apply”. You will then receive a call from one of their persona loan consultants who will submit your application to the bank. The bank will then confirm your application and disburse funds within 5/7 business days.